build Business credit & access capital

We take the guesswork out of obtaining business loans, Lines of Credit and Building Business Credit.

Fast results along with long term financial solutions for your business

In a fast-paced environment, business owners need results and FAST... You can count on us to help you get the capital you need for the short term, long term, AND provide a long term

financial solution to your growth.

How long does it take to build business credit?

How long does it take to build business credit?

Establishing business credit is a process. But it doesn’t have to take forever. You’ll often see that it takes three years for a business to build credit.

While it can be helpful to be in business for that long, you can build a good small business credit profile and business credit score long before that with the MyCompanyCredit Platform.

Business Capital & Term Loans

Your business needs options.

We offer many different loan types to meet your specific needs.

Revenue-based Financing

Revenue-based financing is a form of financing that allows businesses to receive capital in exchange for a percentage of their future revenue.

This option can be beneficial for businesses that have difficulty obtaining traditional loans or investments.

Term Loans & Lines of Credit

Use for investments in your business, such as

expansion projects or large purchases.

Get a one-time lump sum of cash upfront,

with the option to apply for more when you’re

halfway paid down

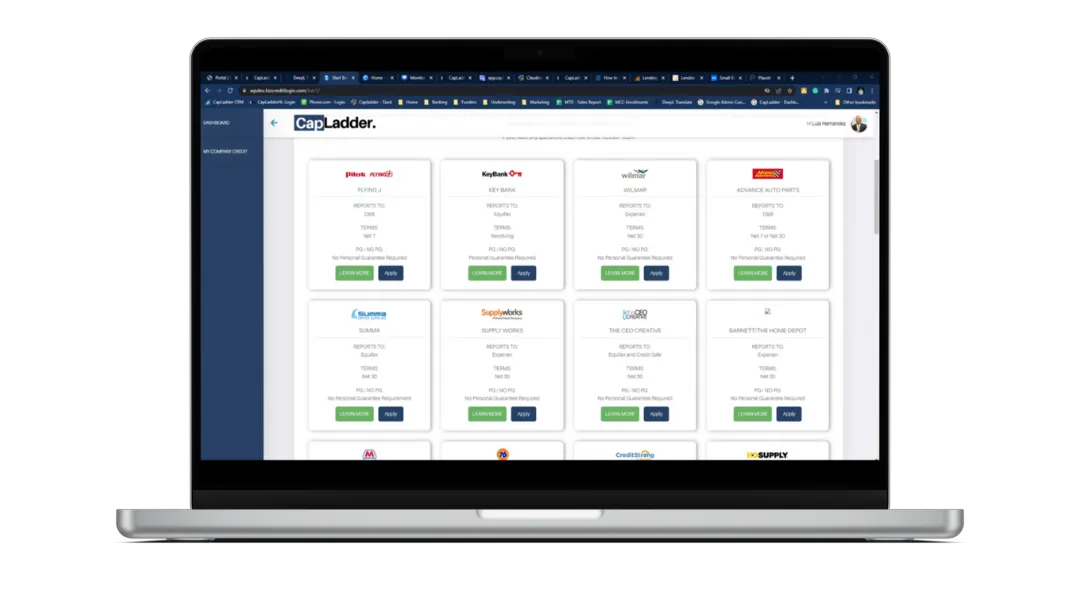

MyCompanyCredit Platform

The MyCompanyCredit Platform can help you with build business credit by doing the heavy lifting for you. We have a team dedicated to finding and maintaining hundreds of business credit accounts.

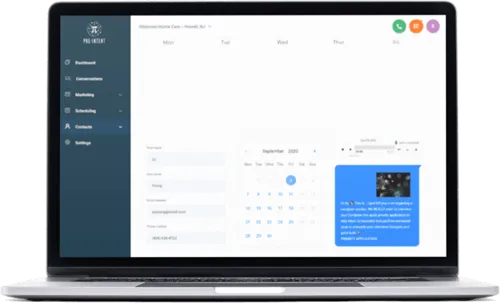

Dedicated Client Success Team

Every client is different, and you need more than a one-size fits all program. Your dedicated Credit Advisor will walk you through every step towards accessing the credit your business deserves.

Proven & tested method to access capital for you business!

We’ve helped thousands of businesses use a streamlined approach to capital & financing. We help you understand & improve over 100 Bank Credibility Factors, establish and use your business credit, and match you with lenders to get loans and credit lines.

MyCompanyCredit Platform with

Vendor Match Technology

Features

Technology and Communication come together - Stay connected on the MyCompanyCredit Platform.

Vendor Match

Connect with vendors ready to extend your business credit - NOW!

Your dedicated Credit Advisor is available daily to answer all your questions.

Text Messages

Email too slow for your needs? We got you covered! Simply send a text and we're there!

Streamlined Qualifications

Meet eligibility requirements lightning fast and access credit resources you never knew existed.

Scheduling Appointments

Schedule a session with your Credit Advisor and connect via screenshare.

Notices

Stay connected and up to date with our Notice Board. From vendors to the latest news.

Meet Spencer

Spencer had the same obstacles like you, but then,

he found us...

perfect combo - capital & credit

It's time to stop getting short term band-aids to solve long-term capital needs.

Opportunities present themselves everyday, and for those situations, you can count on us to get you the capital you need NOW.

But let's also take the opportunity to begin building your business credit profile and gain access to capital you can always tap into.

Have A Question?

To the right you'll find answers to the most frequently asked questions we get. Feel free to reach out to us if you have more questions and we'll be happy to answer them.

How do I get Business Credit that's not linked to my SSN?

Just like how consumer credit is linked to your SSN, your business credit is linked to your EIN. This means when applying for business credit, it's usually not required to include your SSN.

Once you properly establish your business entity and Credibility Foundation, you start off building your business credit profile with smaller vendor accounts. As your business pays those retailers you will then qualify for revolving store credit cards, and then cash credit you can use anywhere, just like a normal personal credit card.

Keep in mind that because of federal regulation you will still need to supply a SSN for identity verification purposes. Also providing a personal guarantee can open up even more financing options.

How long will it take me to build Business Credit?

You can qualify for real usable vendor credit immediately. You’ll then start to qualify for store credit within 60-90 days that doesn’t require a personal credit check or personal guarantee.

Within 6 months you should have access to $50,000 in real usable credit, including Visa and MasterCard accounts.

You can then continue to build $100,000-$250,000 or higher in business credit within a year to two.

Is this complicated? Can I really do this?

Every step of the process includes simple education videos and direct resource links so that your business credit building journey is a 'no-brainer'. In the rare occasions that you need help, you have our business credit advisers and finance officers to help!

So as long as you're committed to follow our instructions and are serious about the success of your business, then yes, you really can do this -- even if you're technically challenged.

With that being said, it's important to understand that we do NOT build your business credit FOR you. We help you through simple step-by-step instructions and education. Essentially, follow our instructions and get results.

Can I build my Business Credit on my own?

It's true that between all of our free guides, articles, videos and seminars, you have enough knowledge to go get business credit all on your own. It's also true that we don't hold anything back in our sharing of knowledge because at the core of our company, we want to help as many business owners (and those aspiring-to-be) as possible to have an equal opportunity to succeed and thrive.

With that being said, there still are services you will have to pay for such as 411 listings, business credit monitoring, and a business credit builder so that you're reporting to the right agencies (costing over $3000), not to mention, you'll still have to go out and find vendors and lenders. There are also lots of limitations going this way.

The difference with us is that we have already established countless partnerships and affiliations, which allows us to fully leverage the power of our entire company and client-base for each individual client. Essentially, you get to leverage our company for your benefit. And due to our established credibility in the business credit and financing industry, it's easy for us to expand and constantly add even more funding sources and options, which YOU benefit from. That’s how we have the largest supply of vendors and credit issuers than anywhere else.

In short, if you were to try and get business credit and financing on your own or somewhere else, you'll pay MUCH more than what we ask, and it would take a lot longer. We have this entire process dialed in so that you can get the most amount of funds, in the shortest amount of time, and at the lowest rates possible.

Hear From Our Clients

We support and empower small businesses with building business credit & flexible financing solutions with world-class service.

By unlocking capital for these underserved micro-entrepreneurs, we enable economic growth within overlooked American communities.

Navigation

© Copyright 2025 | BrokerBot | All rights reserved.